BOOKKEEPING COURSE |

|

|

|

The following pages in our Bookkeeping Course attempt to give a brief summary of the principles of Journal Entry bookkeeping. After reading the material you will find that the "bogey" is not that bad. The Development of Bookkeeping.In each area of life, techniques are developed and inventions made to answer the problems that arise therein. Thus, for example, the invention of the "airplane" provided an answer to the problem of reducing travel time between distant cities. The discovery of "canned foods" on the other hand gave an answer to the need to keep food fresh for long periods. This is similar to what happened with bookkeeping, in that it answered the severe problems that arose in managing modern commerce. It is important to remember that we are in fact talking in a new language that you have yet to learn, as you had to learn any foreign language when young.Before we go into the structure of the language, we will try to see which problems are answered by bookkeeping.

We will go on to the technical part which is, in fact, the structure of the language known as "bookkeeping". As with any other language, this stage resembles learning the alphabet and basic rules of grammar and it is, naturally enough, fairly boring. Try not to skip this stage as it is actually the basis for bookkeeping language. BOOKKEEPING CONVENTIONSBookkeeping language is based on 2 basic conventions:

At this stage, you are of course wondering why we have taken an example from the Middle Ages for commercial life in the 21st century. I am sorry to disappoint you but the situation is very similar today. Let's alter the previous example to suit our times. Let's assume that Jo buys a pair of shows from Jake for $ 80. We can see here as well that although we are concerned with a single commercial transaction (from Jo's point of view - buying shoes for cash, from Jake's point of view - selling shoes for cash). We are still left with the "dual aspect" convention as follows:

In other words, the language of bookkeeping tends to record a single transaction in dual manner. Once, what the tradesman "received", and the second time, what that same trader "gave".

DIVIDING THE TRANSACTION INTO SUBSIDIARY COMPONENTSBookkeeping Does not refer to a business as a single unit but as a body that contains a number of subsidiary units with a particular person being responsible for each subsidiary unit. In order to organize the business activities, we will take a separate sheet of paper that will organize all the activities that are connected to the person in charge. So for example, the Cash Page - will describe everything connected with the cashier, the Goods Page - will describe everything that is connected with the warehouseman, while the Bank Page - will coordinate all that is connected with the person that deals with the banks. Event 1 - We bought goods for $100 cash. Event 2 - We transferred $60 in cash to our bank account. Event 3 - We bought goods from a supplier for $30 that we took out of cash. The bookkeeping records are as follows: Event 1:

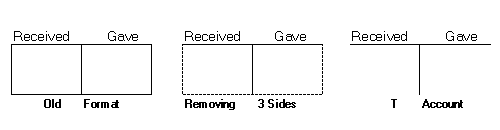

The explanation is very simple: The Goods Page - that describes the events from the point of view of the warehouseman - received an economic value of $ 100. The Cash Page - that describes the event from the point of view of the cashier - gave $ 100. Comment - The decision that the left side of the page reflects "Received" while the right side shows "Gave" has no logical explanation and it is a convention adopted for the sake of uniformity only (rather like the rule that all vehicles travel in the right lane on the roads in most countries, a safety regulation that affects everyone in principle (uniformity). Further Comment: The professional expression for each bookkeeping page is not the "Goods Page" and/or the "Cash Page" but ACCOUNT (as distinct from an account submitted to a supplier for goods or services he :gave" or a tax invoice), somewhat similar to the expression "Report". From this stage on, we will use the expressions "Goods Account" and Cash Account" and so on. Event 2: Let's sketch "Accounts" (pages). It is obvious that the relevant accounts are: the "Bank Account that describes what happened in the transaction from the point of view of the person in charge of the account with the bank and the "Bank Account". The record will look as follows:

Event 3: The record will look like this:

In actual practice, the account looks somewhat different. The three sides are removed from the original account and the resulting format resembles the letter 'T'. In fact, the custom is to call accounts by the name 'T Accounts'.

Bookkeeping Course: TYPES OF ACCOUNTS

Until now we have learned that the left hand side of the account is called 'Received' and the right hand side is called 'Gave'. The correct expressions that are used in the profession are: The left hand side (the 'Received' side)- the Debit Side. The right hand side (the 'Gave' side)- the Credit Side. Moreover, there are clear rules as to when to debit the account (that is to say, to enter the record on the left hand side) and when to credit the account (that is to say, to enter the record in the right hand side). We shall use the following tables and the example that follows it to help us understand more fully: Bank Reconciliation Salaries Tax Deduction at Source Value added tax |